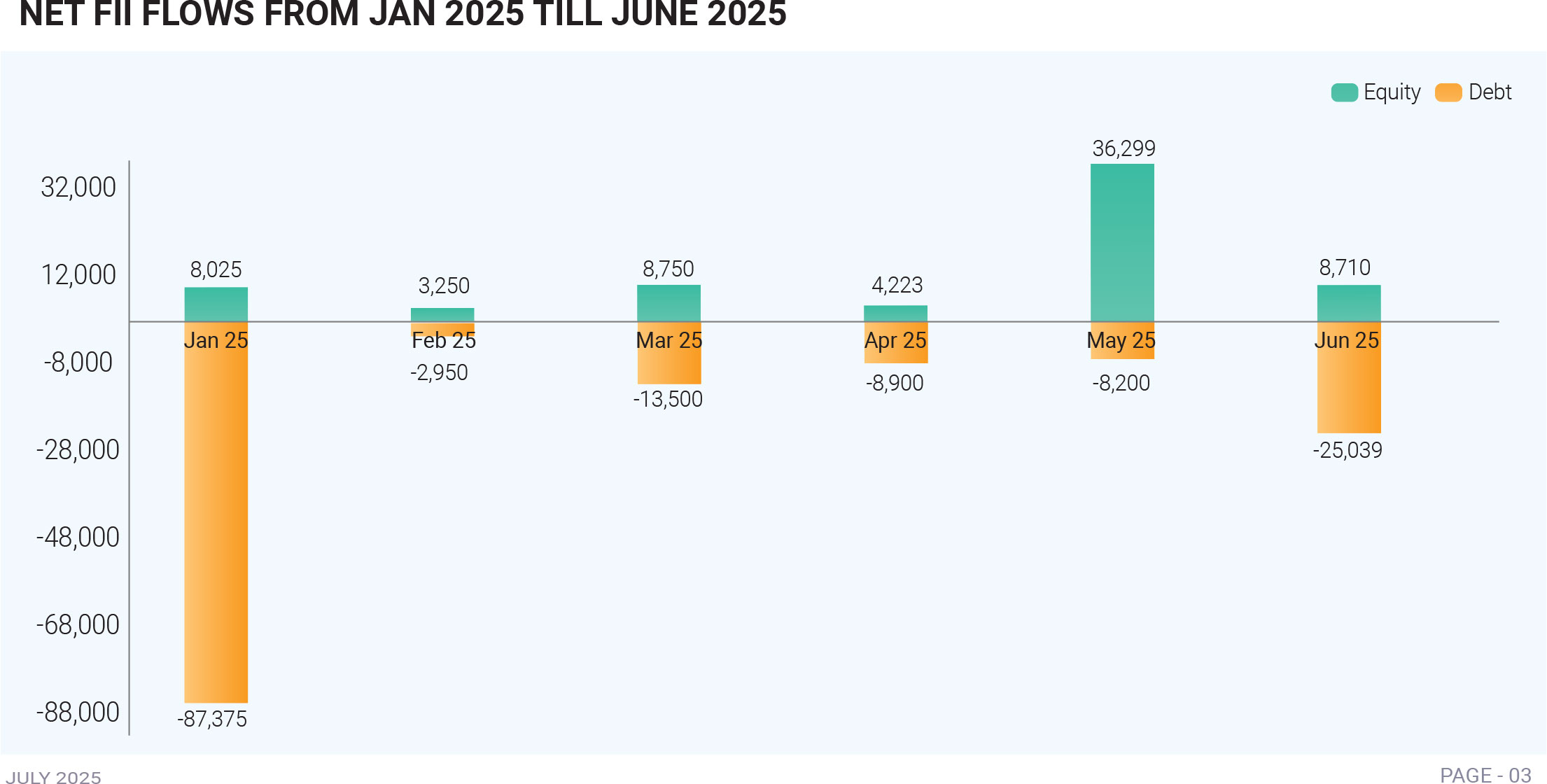

June 2025 proved to be a turbulent month for India’s debt markets, characterized by a sharp rise in bond yields, large-scale foreign portfolio outflows, and heightened investor caution. The benchmark 10-year government bond yield rose 11 basis points to 6.32%, marking its steepest monthly increase since April 2024. The 6.75% 2029 bond saw an even more dramatic 16 basis point surge, the largest in over two years. This broad-based bond sell-off was primarily triggered by the Reserve Bank of India’s unexpected policy move: while the RBI cut the repo rate by 50 basis points to support growth, it simultaneously shifted its stance from “accommodative” to “neutral.” This policy pivot surprised investors, who interpreted it as a signal that further rate cuts would be limited. As a result, the initial rally following the rate cut gave way to a sell-off, especially in long-duration bonds, leading to a bear steepening of the yield curve. Foreign investors, too, reacted sharply. FPIs withdrew ₹25,038 crore from Indian debt markets in June, reversing inflows from May. The sell-off spanned both the Fully Accessible Route (FAR) and the Voluntary Retention Route (VRR), highlighting a broad retreat from Indian fixed-income assets. A narrowing spread between Indian and U.S. bond yields—down to 204 basis points—diminished the relative attractiveness of Indian bonds, particularly when paired with a weakening rupee and rising currency risk. Globally, stronger-than-expected U.S. data and hawkish Fed commentary drove U.S. yields higher, compounding the pressure on Indian debt. Adding to market stress was a spike in Brent crude oil to $81.40 early in the month amid Middle East tensions, reviving inflation fears and dampening demand for Indian bonds. Domestically, risk appetite also cooled. While mutual funds and banks continued to participate in auctions, demand at state government bond auctions weakened, with some yields temporarily crossing 7%. Short-term yields held firm due to surplus liquidity and RBI support, but long-term yields climbed sharply, reflecting investor unease about inflation, fiscal health, and policy direction. Profit booking after earlier bond market gains further weighed on sentiment. On the corporate debt front, spreads widened, especially for lower-rated securities, as investors turned risk-averse. Demand shifted toward high-quality instruments, and issuance of certificates of deposit (CDs) surged as public sector banks managed liquidity needs, supported by mutual fund buying. The curve steepening indicated growing uncertainty regarding fiscal and monetary policies. Despite resilient domestic participation from banks, insurers, and mutual funds, the magnitude of FPI outflows and global headwinds overwhelmed the market. The month marked the steepest sell-off in over a year, not due to any deterioration in India's macro fundamentals—growth was stable and inflation contained—but rather due to a sudden shift in policy expectations and global repricing of risk. As June ended, the market faced a critical juncture. While India's economic outlook remains solid, elevated yields may persist due to external volatility, a firm U.S. dollar, oil price uncertainty, and diminished foreign appetite. The episode underscored the fragile balance debt markets must maintain amid unpredictable global and domestic crosscurrents.

May began with cautious FPI flows across debt segments, but sentiment improved sharply in the final week. The General Debt segment saw a remarkable reversal as foreign investors poured in ₹27,115 crore on May 30, signalling renewed appetite for Indian sovereign and corporate debt amid stable global yields and supportive macroeconomic signals. In contrast, the FAR segment recorded its steepest monthly outflow ever—₹12,320 crore, attributed primarily to profit-taking after a strong run, rising U.S. Treasury yields, and rupee depreciation pressures, rather than a structural shift in sentiment. The Reserve Bank of India (RBI) injected ₹1.25 lakh crore in liquidity through open market operations and repo interventions during May. This eased money market conditions, supported government bond prices, and helped 10-year G-Sec yields drift lower to 6.35%. With inflation at a six-year low and policy accommodative, the environment remained favourable for debt investors, particularly in medium- to long-duration bonds. Government bond yields declined steadily, underpinned by surplus liquidity, softening inflation, and expectations of dovish RBI guidance. This encouraged both institutional and retail investment in G-Secs and high-rated corporate bonds. Short-term instruments, including Treasury bills, PSU commercial paper (CP), and certificates of deposit (CDs), also saw rates soften, enhancing returns for short-duration and money market funds. Corporate bond yields continued to decline moderately, with sustained demand from domestic institutions. The spread between 10-year AAA-rated corporate bonds and G-Secs narrowed, reflecting an improved risk appetite and the market’s confidence in macroeconomic stability.