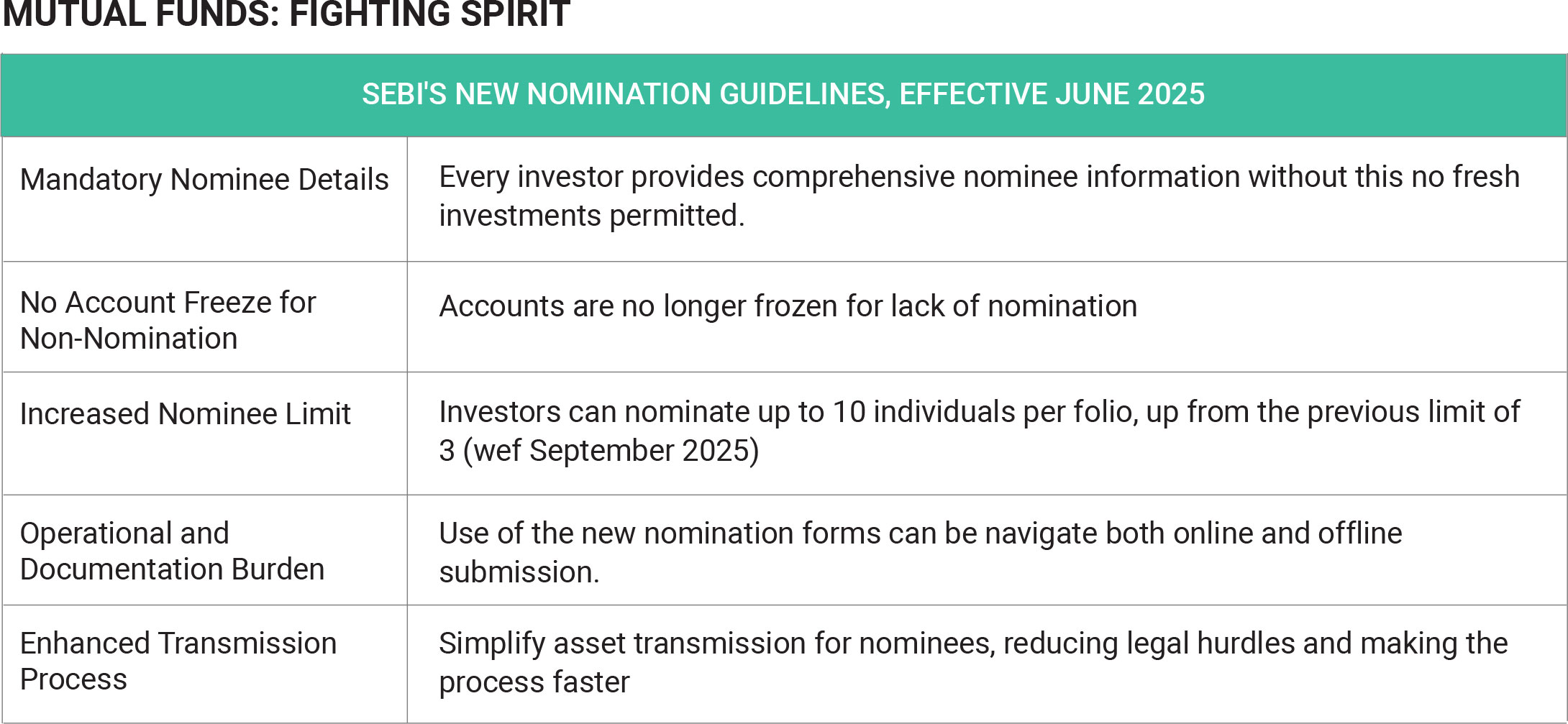

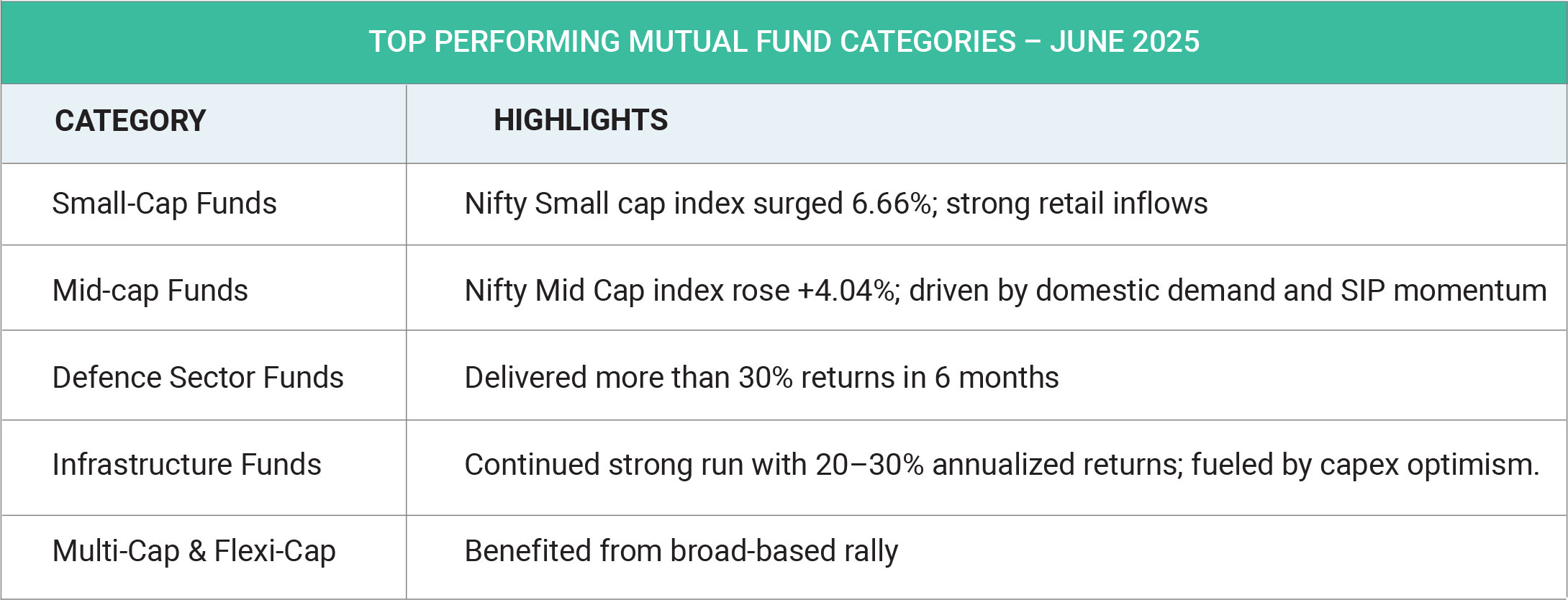

In June 2025, the Indian mutual fund industry saw a standout performance from defence sector funds, which surged up to 39% over the past three months. This rally was fuelled by increased government defence spending, policy support under Make in India and Atmanirbhar Bharat, and rising geopolitical tensions. The sharp rise in these funds signalled a growing investor shift toward thematic investments and highlighted how policy changes and global events can swiftly influence fund flows and shape market sentiment in India At the Moneycontrol Mutual Fund Summit 2025, the remarkable growth and evolving dynamics of India’s mutual fund industry over the past five years were prominently highlighted. The industry’s assets under management (AUM) soared from ₹24.55 trillion in 2020 to ₹72.20 trillion in 2025, nearly tripling in size—underscoring a significant rise in investor participation and confidence. Monthly Systematic Investment Plan (SIP) inflows also saw impressive growth, climbing from ₹3,000 crore a decade ago to ₹26,688 crore in 2025. This sharp increase reflects a strong and sustained shift toward disciplined, long-term investing, particularly among retail investors across the country. Retail participation expanded significantly, with the number of folios reaching 23.4 crore and retail investors’ share in AUM rising from 23% to 28%. Smaller towns (B-30 cities) played a pivotal role, doubling their AUM contribution from 9% to 18.4%, signalling deepening financial inclusion. A wave of product innovation also reshaped the market, with thematic and sectoral funds—particularly in defence, technology, and equal-weight strategies—gaining popularity. This reflected the market’s maturity and growing appetite for targeted investment solutions. Regulatory efforts by SEBI were instrumental in strengthening transparency and investor protection. With robust disclosures, enhanced investor education, and clear governance, the Indian mutual fund industry closed June 2025 on a historic high, poised for sustainable growth ahead. The Indian mutual fund industry in June 2025 demonstrated strong growth, record AUM, and high SIP inflows, with sectoral and thematic funds—especially in defence—gaining traction, even as some categories like small cap and pharma saw short-term underperformance. The expansion was driven by increased retail participation, product innovation, and supportive regulatory and economic conditions.