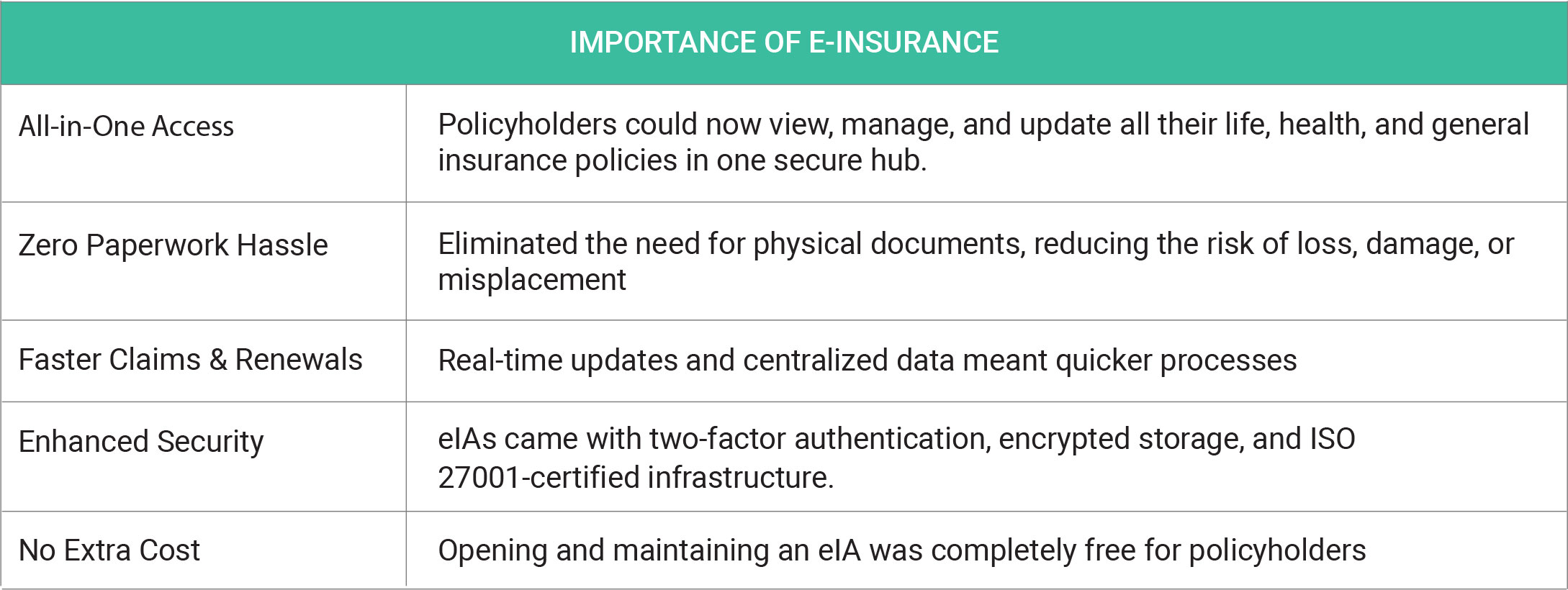

In June 2025, India’s life insurance industry recorded a robust 13% rise in premiums, signalling a strong revival after a phase of subdued growth. This upturn was largely fuelled by private insurers, whose new business premiums (NBP) surged by 16.6%, while LIC also posted a solid 10–11% increase. The industry collected over ₹30,463 crore in new business premiums in May, reflecting strong revenue growth despite a 10.4% decline in policy count—largely due to new surrender value norms introduced in October 2024. Private insurers led the momentum, with standout performers like HDFC Life and SBI Life reporting 33% and 25% premium growth, respectively. This shift highlights intensifying competition and evolving marketdynamics. The growth was primarily driven by group single premium products, which grew 13% year-on-year, while individual policy sales remained muted. LIC maintained steady performance, reporting an 11% rise in total premiums and a 21% increase in annualized premium equivalent (APE), although its retail APE saw a decline—signalling its reliance on group business for growth. The implementation of mandatory e-insurance in June 2025 marked a transformative shift for Indian policyholders, bringing insurance into the digital age with tangible benefits: Despite the impact of regulatory changes on product

mix and policy volumes, the overall industry trend remained positive. The premium surge, driven by private sector strength and innovation, sets a constructive outlook for the remainder of FY 2025–26.