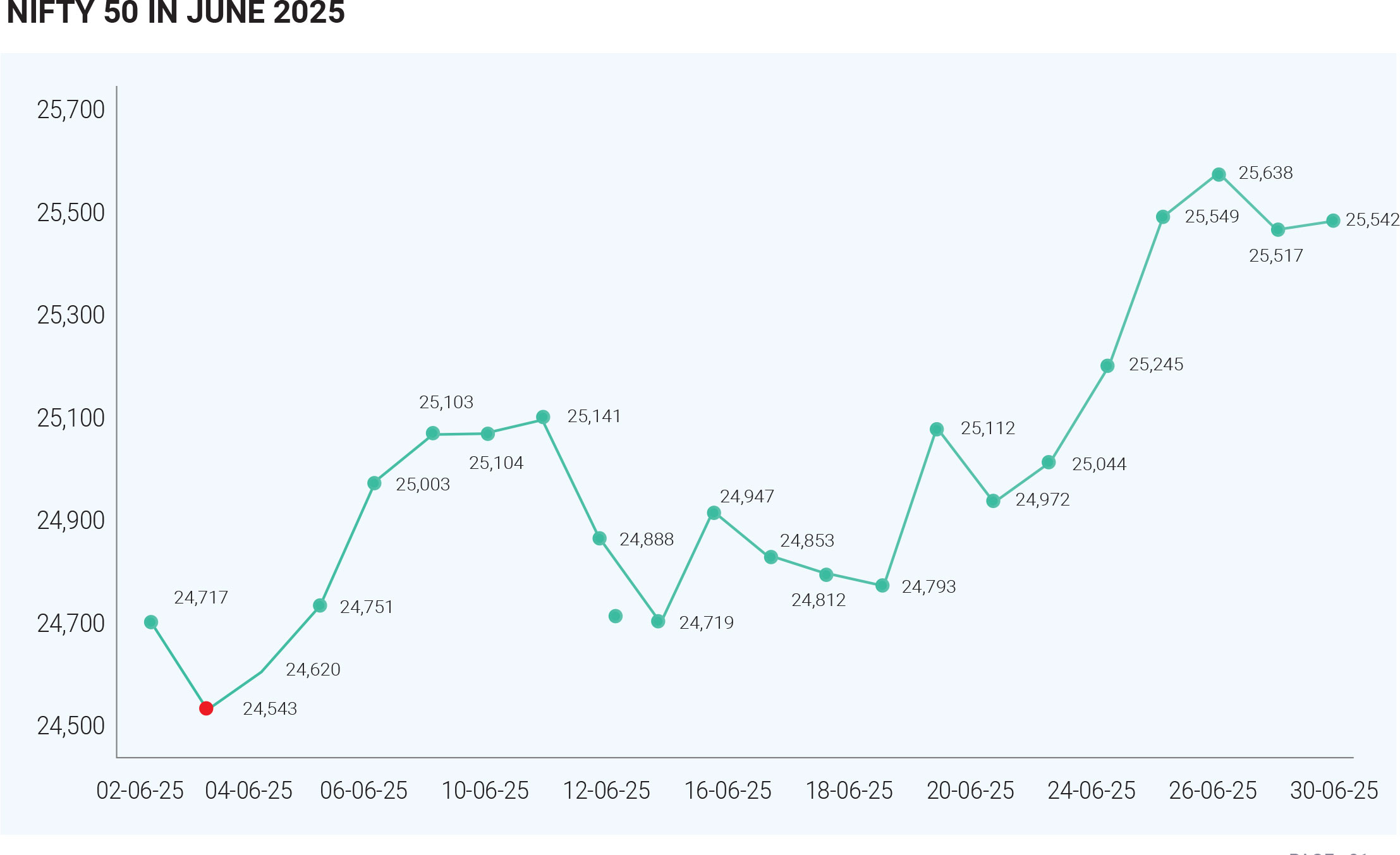

June 2025 was a pivotal and eventful month for Indian equity markets, with the Sensex and Nifty registering impressive gains of 2.65% and 3.1% respectively, despite being tested by intense geopolitical uncertainty, sectoral shifts, and sharp fluctuations in investor sentiment. The first half of the month was defined by heightened global tensions as conflict between Iran and Israel threatened to escalate into a broader crisis, with Iran’s threat to block the Strait of Hormuz sending oil prices surging and sparking a wave of panic selling across global equity markets. Safe-haven assets like gold and the U.S. dollar spiked, while Indian indices retreated sharply dragged down by crude sensitivity and global risk aversion.

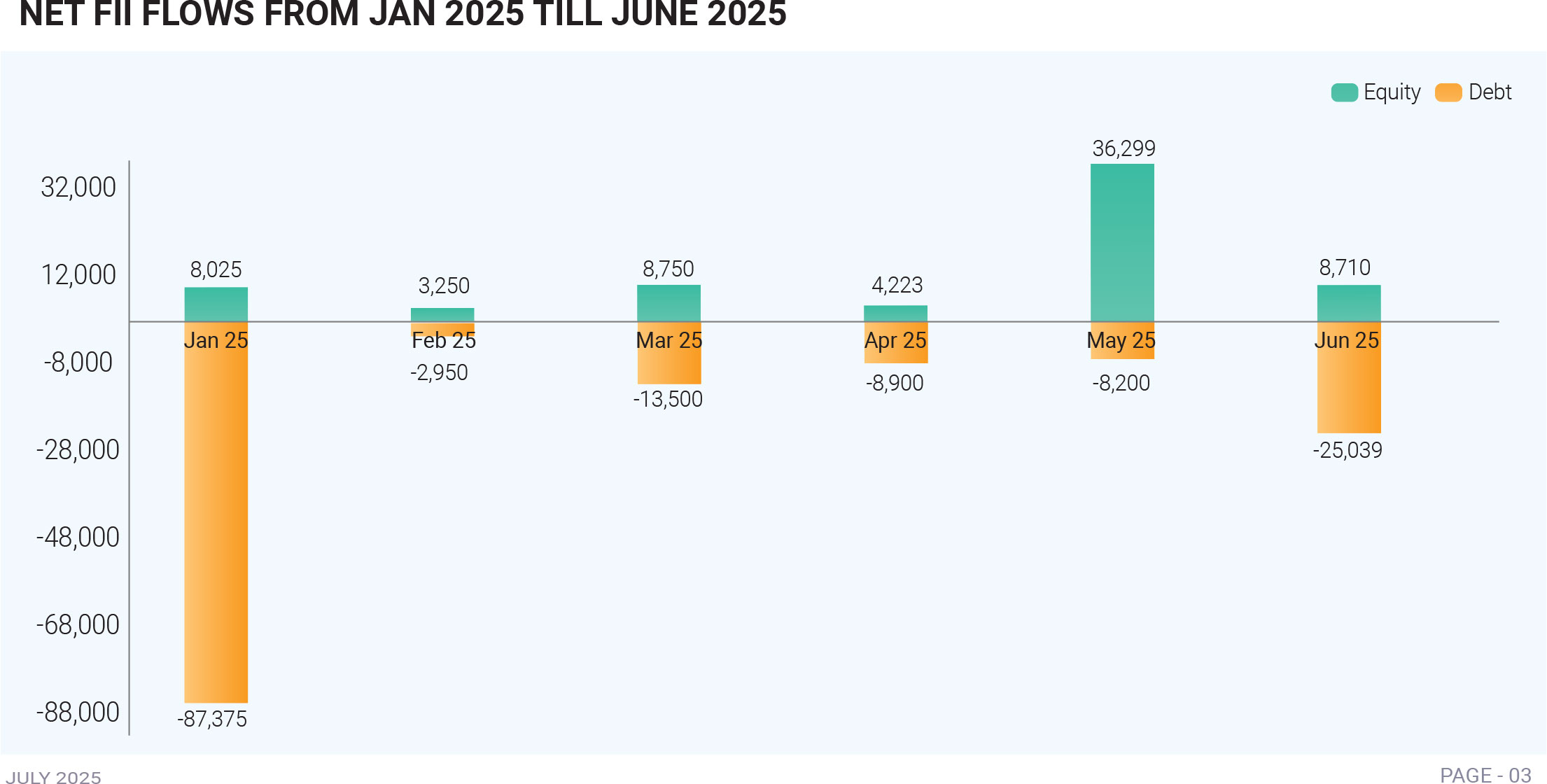

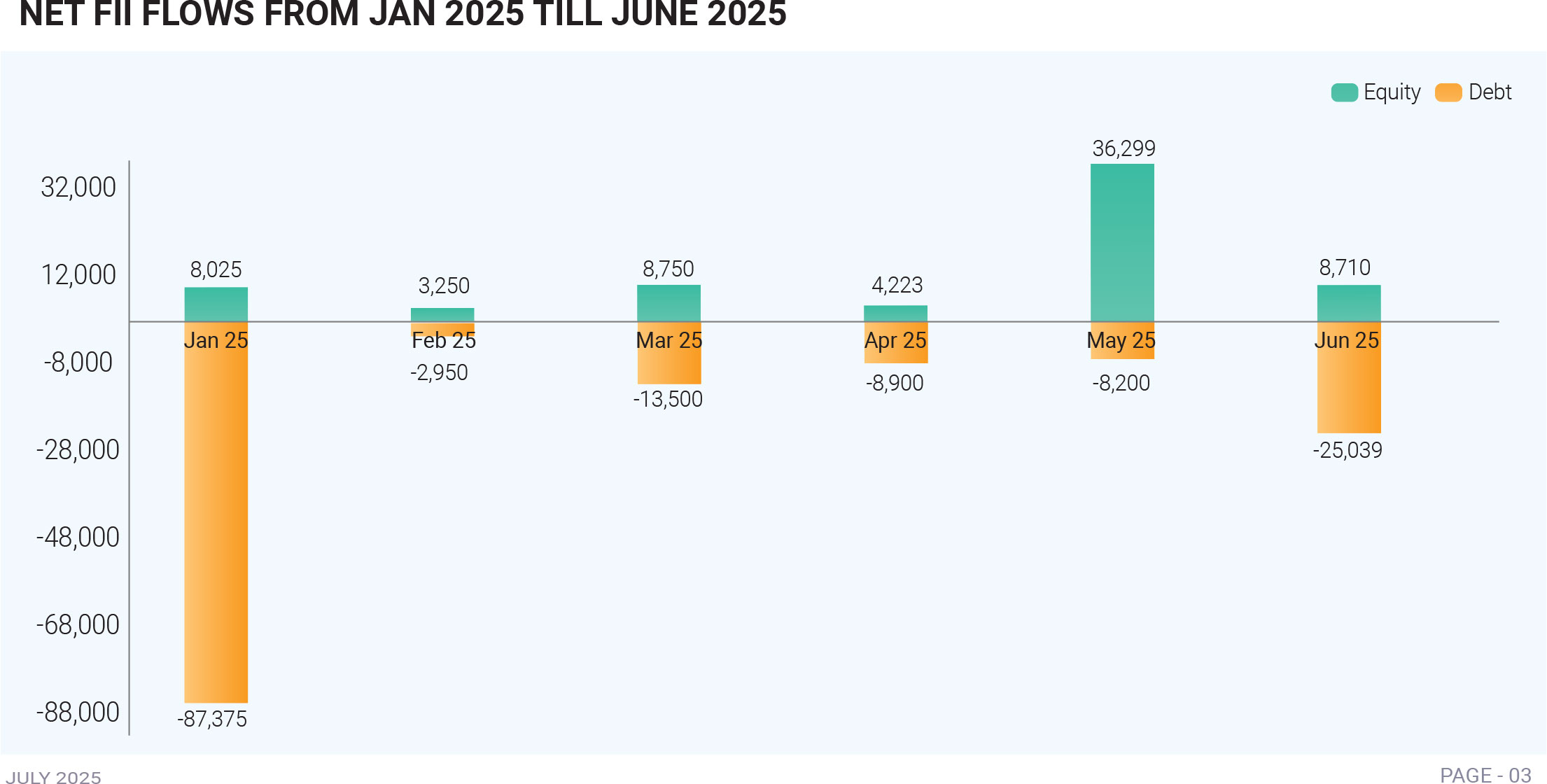

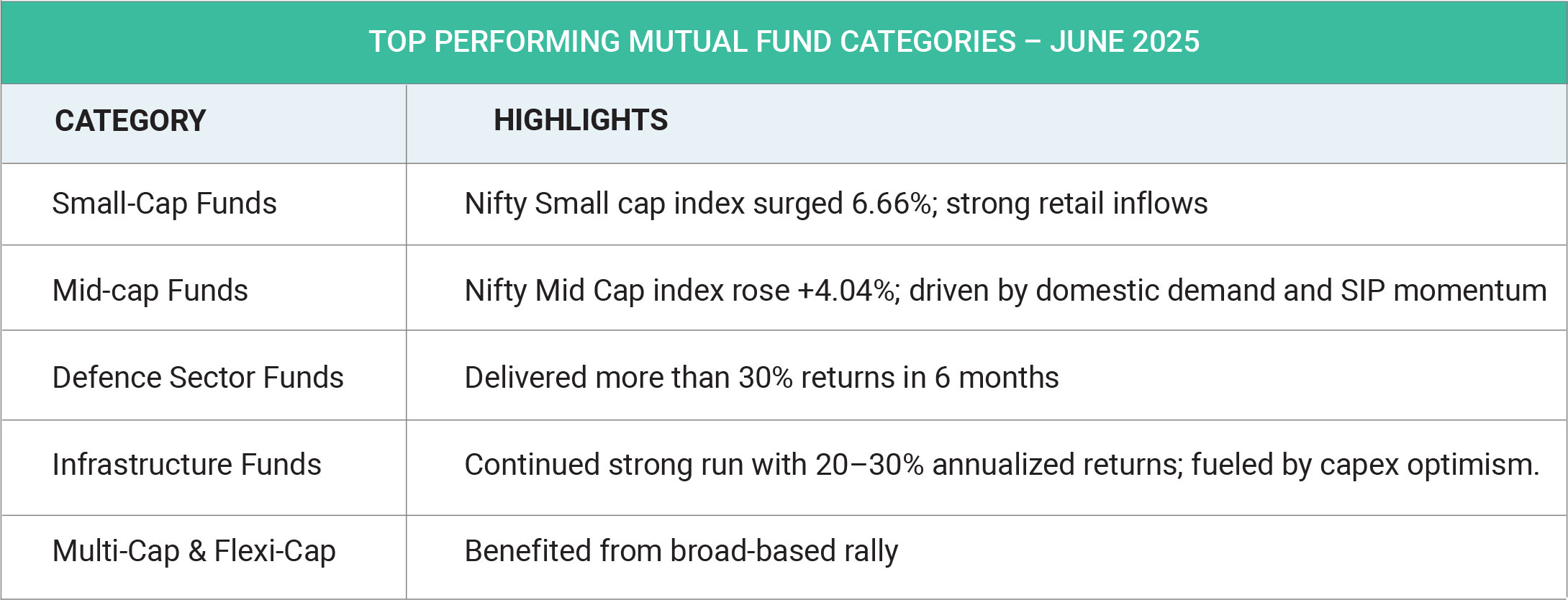

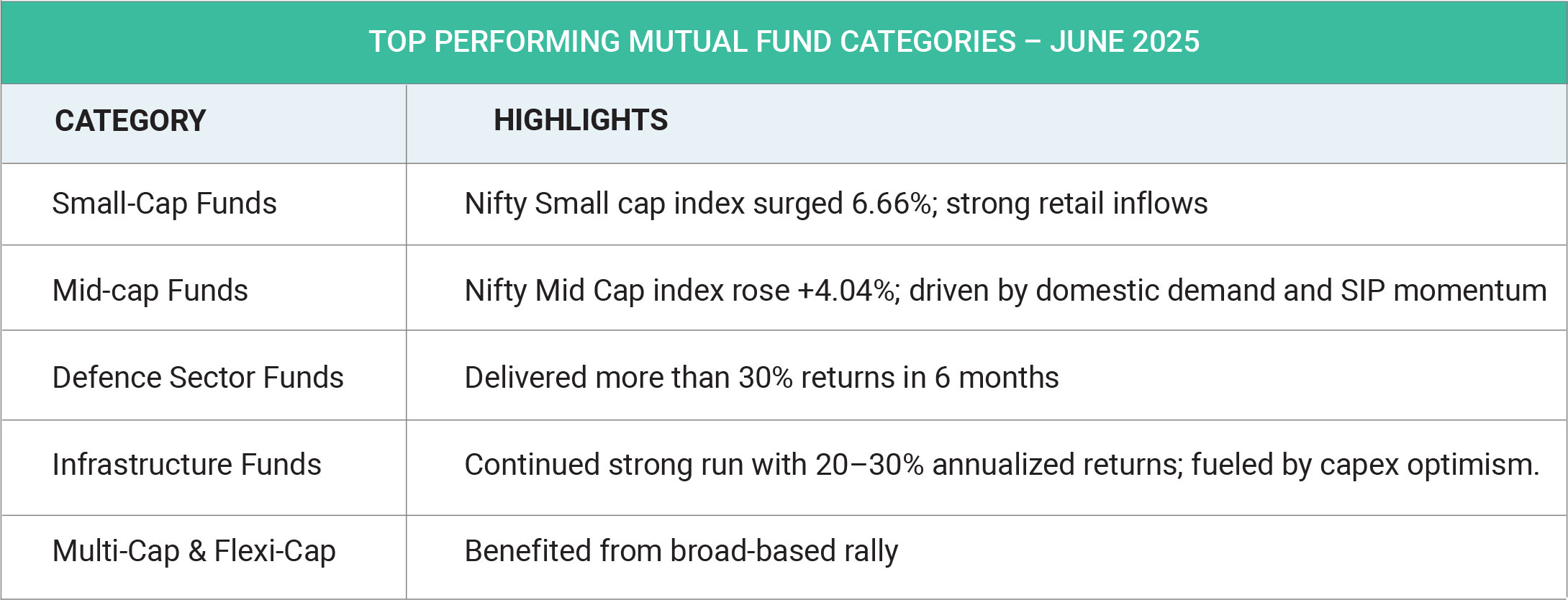

IT stocks, including bluechips suffered the most as fears of soft global tech demand took hold, and the Sensex slumped to an intraday low of 81,476.76 on June 23, while the Nifty dipped to 24,824.85. However, the markets staged a remarkable turnaround following a mid-month ceasefire announcement between Iran and Israel, which dramatically improved risk sentiment and reignited optimism. This geopolitical easing, coupled with falling crude oil prices and a weakening U.S. dollar, made Indian equities attractive again to foreign investors, sparking renewed Foreign Institutional Investor (FII) inflows that fuelled a powerful second-half rally. The Sensex rebounded 700 points on June 25 to close at 82,756, while the Nifty crossed the 25,200 mark for the first time in 2025. For sector performance, the rally was led by private financials, PSU banks, infrastructure, IT, and defence-linked stocks, with midcap and smallcap segments outperforming large caps. The Nifty Smallcap 100 index surged 6.66%, reflecting the market’s growing appetite for high-risk, high-reward investments. This shift in risk appetite also indicated a broad-based rally driven by strong domestic retail participation, mutual fund SIP inflows, and a sustained bull run in broader markets. Notably, defence and shipbuilding stocks rallied strongly due to increased government spending and a clear policy push, while sectors like FMCG and Realty lagged as investors rotated out of defensive plays into growth sectors. However, despite the upbeat mood, the month was not without headwinds. A surge in equity supply through IPOs and large block deals in the second half of June tested market liquidity, absorbing investor funds and leading to intermittent consolidation and profit booking, especially in overbought counters. The final trading session on June 30 saw mild correction: the Sensex dropped 452 points to close at 83,606.46 and the Nifty lost 120 points to end at 25,517.05, snapping a four-day rally. Still, broader indices like the BSE Midcap and Smallcap held firm, reflecting continued confidence in India’s long-term growth story. The rotation out of defensive sectors was largely strategic—FMCG, for example, underperformed due to persistent margin pressures and concerns over volume growth, particularly in rural markets. Meanwhile, Auto and PSU banks enjoyed renewed investor interest on the back of robust credit growth, improved NPAs, and strong policy support. Retail investor participation remained high despite foreign volatility, helping absorb FII outflows in early June and providing stability to the market during its more volatile phases. From a macroeconomic perspective, the Indian economy remained resilient with stable inflation, upbeat industrial production numbers, and healthy credit growth—especially in retail and MSME segments—underpinning investor optimism. Additionally, positive developments such as USFDA approvals in the pharma space and robust quarterly updates from select companies gave a further boost to individual stocks and sectoral indices. Technically, the markets displayed a classic recovery, with sentiment swinging from bearishness in the first half of June to a renewed bull run in the latter part, driven by easing geopolitical risks and improving global macro indicators. Notably, foreign flows turned positive after June 20, with sustained buying in banks, energy, and infrastructure counters. As the month ended, investors were left balancing optimism with caution. On one hand, domestic fundamentals, liquidity, and earnings resilience provided a strong foundation; on the other, the rush of IPOs, the possibility of global rate actions, and ongoing geopolitical fragility posed potential risks. For investors, June was a reminder that markets are no longer just indicators of economic performance—they are real-time barometers of sentiment, reacting swiftly to headlines, policy shifts, and capital flows. Sector rotation was another key theme, with the market moving decisively from defensives like FMCG into cyclical and policy-driven sectors such as infrastructure, public sector enterprises, and defence, reflecting confidence in India's capital expenditure cycle and fiscal discipline. In conclusion, June 2025 showcased the complexity and resilience of Indian equity markets. It was a month marked by sharp corrections and equally sharp recoveries, by cautious optimism and bold sectoral bets. Despite initial volatility triggered by geopolitical unrest, the underlying strength of the domestic economy, combined with favourable global cues, drove a strong rally in the second half. With the Sensex and Nifty ending the month on a high note and broader indices outperforming, the market demonstrated its ability to absorb shocks, recalibrate quickly, and reward quality amid uncertainty. As the second half of the year begins, the key message for investors is to stay agile, keep quality at the core, and be prepared for episodic volatility—because the markets, as June 2025 proved, are sentiment machines first and foremost, finely tuned to every global whisper and domestic signal.

June 2025 proved to be a turbulent month for India’s debt markets, characterized by a sharp rise in bond yields, large-scale foreign portfolio outflows, and heightened investor caution. The benchmark 10-year government bond yield rose 11 basis points to 6.32%, marking its steepest monthly increase since April 2024. The 6.75% 2029 bond saw an even more dramatic 16 basis point surge, the largest in over two years. This broad-based bond sell-off was primarily triggered by the Reserve Bank of India’s unexpected policy move: while the RBI cut the repo rate by 50 basis points to support growth, it simultaneously shifted its stance from “accommodative” to “neutral.” This policy pivot surprised investors, who interpreted it as a signal that further rate cuts would be limited. As a result, the initial rally following the rate cut gave way to a sell-off, especially in long-duration bonds, leading to a bear steepening of the yield curve. Foreign investors, too, reacted sharply. FPIs withdrew ₹25,038 crore from Indian debt markets in June, reversing inflows from May. The sell-off spanned both the Fully Accessible Route (FAR) and the Voluntary Retention Route (VRR), highlighting a broad retreat from Indian fixed-income assets. A narrowing spread between Indian and U.S. bond yields—down to 204 basis points—diminished the relative attractiveness of Indian bonds, particularly when paired with a weakening rupee and rising currency risk. Globally, stronger-than-expected U.S. data and hawkish Fed commentary drove U.S. yields higher, compounding the pressure on Indian debt. Adding to market stress was a spike in Brent crude oil to $81.40 early in the month amid Middle East tensions, reviving inflation fears and dampening demand for Indian bonds. Domestically, risk appetite also cooled. While mutual funds and banks continued to participate in auctions, demand at state government bond auctions weakened, with some yields temporarily crossing 7%. Short-term yields held firm due to surplus liquidity and RBI support, but long-term yields climbed sharply, reflecting investor unease about inflation, fiscal health, and policy direction. Profit booking after earlier bond market gains further weighed on sentiment. On the corporate debt front, spreads widened, especially for lower-rated securities, as investors turned risk-averse. Demand shifted toward high-quality instruments, and issuance of certificates of deposit (CDs) surged as public sector banks managed liquidity needs, supported by mutual fund buying. The curve steepening indicated growing uncertainty regarding fiscal and monetary policies. Despite resilient domestic participation from banks, insurers, and mutual funds, the magnitude of FPI outflows and global headwinds overwhelmed the market. The month marked the steepest sell-off in over a year, not due to any deterioration in India's macro fundamentals—growth was stable and inflation contained—but rather due to a sudden shift in policy expectations and global repricing of risk. As June ended, the market faced a critical juncture. While India's economic outlook remains solid, elevated yields may persist due to external volatility, a firm U.S. dollar, oil price uncertainty, and diminished foreign appetite. The episode underscored the fragile balance debt markets must maintain amid unpredictable global and domestic crosscurrents.

May began with cautious FPI flows across debt segments, but sentiment improved sharply in the final week. The General Debt segment saw a remarkable reversal as foreign investors poured in ₹27,115 crore on May 30, signalling renewed appetite for Indian sovereign and corporate debt amid stable global yields and supportive macroeconomic signals. In contrast, the FAR segment recorded its steepest monthly outflow ever—₹12,320 crore, attributed primarily to profit-taking after a strong run, rising U.S. Treasury yields, and rupee depreciation pressures, rather than a structural shift in sentiment. The Reserve Bank of India (RBI) injected ₹1.25 lakh crore in liquidity through open market operations and repo interventions during May. This eased money market conditions, supported government bond prices, and helped 10-year G-Sec yields drift lower to 6.35%. With inflation at a six-year low and policy accommodative, the environment remained favourable for debt investors, particularly in medium- to long-duration bonds. Government bond yields declined steadily, underpinned by surplus liquidity, softening inflation, and expectations of dovish RBI guidance. This encouraged both institutional and retail investment in G-Secs and high-rated corporate bonds. Short-term instruments, including Treasury bills, PSU commercial paper (CP), and certificates of deposit (CDs), also saw rates soften, enhancing returns for short-duration and money market funds. Corporate bond yields continued to decline moderately, with sustained demand from domestic institutions. The spread between 10-year AAA-rated corporate bonds and G-Secs narrowed, reflecting an improved risk appetite and the market’s confidence in macroeconomic stability.

In June 2025, the Indian rupee underwent a turbulent yet ultimately resilient journey, beginning the month under heavy pressure before staging a notable recovery. Initially, the rupee weakened sharply, falling from around ₹85.60–₹85.70 per U.S. dollar to a low of ₹86.74 by June 19—its weakest in over a month. This decline was fuelled by sustained foreign portfolio investment (FPI) outflows from Indian debt markets exceeding ₹25,000 crore, triggered by global risk aversion and shrinking interest rate differentials between Indian bonds and U.S. Treasuries. Escalating geopolitical tensions in the Middle East, particularly between Israel and Iran, further spooked markets, pushing Brent crude oil prices above $81 per barrel. As a major oil importer, India faced heightened concerns over inflation and current account pressure, compounding the rupee’s weakness. Simultaneously, a strong U.S. dollar—buoyed by hawkish Fed commentary and firm U.S. economic data—amplified the rupee's depreciation. However, the tide turned in the second half of the month. Geopolitical risks subsided following ceasefire developments, while Brent crude corrected by nearly 12% to under $68 per barrel, alleviating inflation fears. The resulting improvement in risk appetite bolstered emerging market currencies, including the rupee. Softening U.S. economic data also raised hopes of a Fed rate cut, weakening the dollar and aiding the rupee’s rebound. Domestically, buoyant equity markets and renewed FPI inflows supported foreign exchange reserves. The Reserve Bank of India played a stabilizing role by selling dollars strategically and managing forward positions without draining reserves. By June 27, the rupee recovered to ₹85.49, up 1.1% from earlier lows, closing the month about 0.43% stronger. Though still among Asia’s weaker performers, the rupee’s rebound reflected India’s macroeconomic resilience and effective currency management amid ongoing global volatility.

The Indian debt market in May 2025 reflected a nuanced interplay of domestic strength and global headwinds. While profit-taking and rupee volatility triggered heavy selling in index-linked (FAR) bonds, the broader market sentiment remained resilient, thanks to late-month FPI inflows into General Debt, RBI liquidity support, and softening yields. Demand for high-quality corporate and green bonds in the primary market further underscored investors’ confidence in India's long-term fundamentals. Going into June, debt market participants will be watching the RBI’s policy stance, currency stability, and global rate trends, which will be crucial in sustaining momentum across segments.

Crude oil prices in June 2025 experienced significant volatility, ultimately ending the month on a bearish note. Both Brent and WTI crude retreated to the $66–$68 per barrel range, despite a sharp rally earlier in the month. The initial surge in oil prices was driven by heightened geopolitical tensions in the Middle East, particularly the escalating conflict between Israel and Iran. Fears of a potential disruption in crude shipments through the Strait of Hormuz—one of the world’s most critical oil transit points—pushed Brent crude to a six-month high of $74 per barrel. Additional market anxiety stemmed from cyberattacks on Saudi Aramco infrastructure and broader instability in West Asia, prompting traders to price in a geopolitical risk premium. However, as diplomatic efforts progressed and ceasefire talks gained momentum, tensions began to ease, triggering a sharp correction in oil prices by mid-June. This decline was further reinforced by the release of U.S. inventory data showing crude stockpiles rising to a 10-month high, signaling weakening demand and potential oversupply. Economic uncertainty in China and stagnant industrial activity in Europe also weighed on demand expectations, while U.S. summer travel demand offered limited support. On the supply side, although OPEC+ maintained production cuts and Russian exports declined due to both quota commitments and technical disruptions, these efforts were insufficient to counteract bearish pressures. Market sentiment was further undermined by a lack of clear guidance from OPEC+ and unresolved tensions between Saudi Arabia and Russia over future output levels. Meanwhile, the delayed refill of the U.S. Strategic Petroleum Reserve removed a key source of potential demand, exacerbating the downward trend. As speculative investors reduced long positions, oil prices continued to decline. By month-end, the market had shifted back to fundamentals, with prices stabilizing lower amid easing geopolitical risks, rising inventories, and subdued global demand.

In June 2025, the Indian bullion market experienced a dynamic yet broadly positive month, marked by high price levels, brief volatility, and a late-month correction in both gold and silver. Gold prices reached new historic highs during the month. On June 16, MCX gold touched an all-time peak of ₹1,01,078 per 10 grams, reflecting heightened safe-haven demand amid escalating geopolitical tensions, especially the Israel–Iran conflict. However, as tensions eased and global risk appetite improved slightly, gold prices began to retreat. By the end of June, domestic prices had corrected to a range of ₹97,515–₹98,732 per 10 grams. Silver followed a similar trajectory, albeit with more pronounced volatility due to its dual role as both a precious and industrial metal. Silver prices surged past ₹1,05,750 per kilogram mid-month, mirroring gold’s rally, before retreating toward ₹1,03,555–₹1,05,750 per kg. Weak demand from sectors like electronics and solar panels contributed to silver’s softness, though overall investor sentiment remained cautiously bullish. Investment trends in June highlighted diverging behaviour. While jewellery demand slowed significantly after the peak wedding season, investment in physical gold such as bars and coins remained resilient. Buyers, especially retail investors, continued to accumulate gold in anticipation of further long-term gains. Additionally, regulatory support—such as the Reserve Bank of India’s relaxed norms for gold-backed lending—helped sustain institutional and retail interest. Gold exchange-traded funds (ETFs) saw steady inflows in both May and June, underscoring the ongoing preference for gold as a hedge against economic uncertainty and market volatility. The broader global backdrop—featuring U.S. interest rate cuts, a weaker dollar, and lingering geopolitical tensions involving Iran, Israel, and India-Pakistan—contributed to gold’s robust 25% year-to-date returns. In summary, the Indian bullion market in June 2025 reflected a phase of recalibration. After record-breaking highs, both gold and silver entered a phase of mild correction and consolidation. While short-term volatility may persist, driven by evolving global conditions, investor sentiment remains cautiously optimistic, especially with the potential for renewed geopolitical flare-ups and central bank easing on the horizon

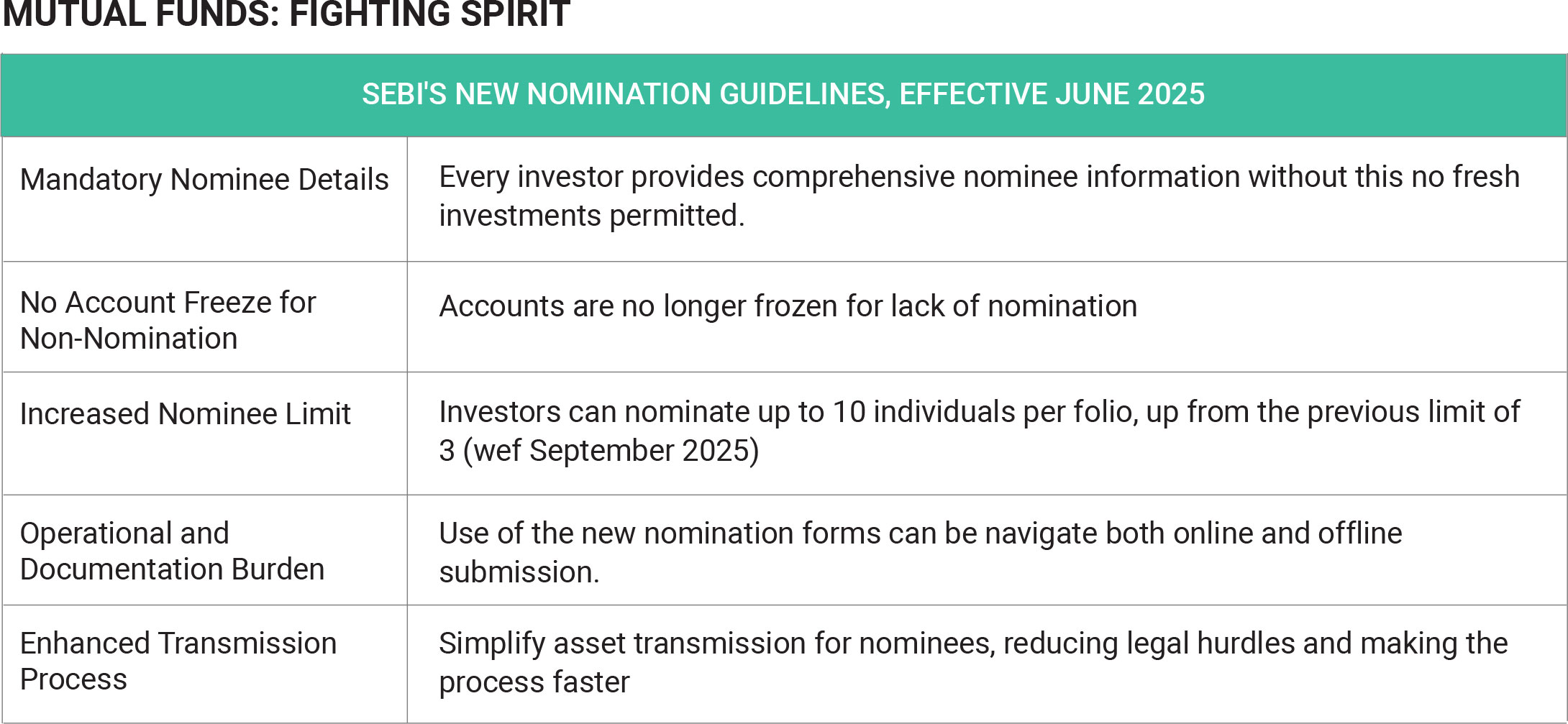

In June 2025, the Indian mutual fund industry saw a standout performance from defence sector funds, which surged up to 39% over the past three months. This rally was fuelled by increased government defence spending, policy support under Make in India and Atmanirbhar Bharat, and rising geopolitical tensions. The sharp rise in these funds signalled a growing investor shift toward thematic investments and highlighted how policy changes and global events can swiftly influence fund flows and shape market sentiment in India At the Moneycontrol Mutual Fund Summit 2025, the remarkable growth and evolving dynamics of India’s mutual fund industry over the past five years were prominently highlighted. The industry’s assets under management (AUM) soared from ₹24.55 trillion in 2020 to ₹72.20 trillion in 2025, nearly tripling in size—underscoring a significant rise in investor participation and confidence. Monthly Systematic Investment Plan (SIP) inflows also saw impressive growth, climbing from ₹3,000 crore a decade ago to ₹26,688 crore in 2025. This sharp increase reflects a strong and sustained shift toward disciplined, long-term investing, particularly among retail investors across the country. Retail participation expanded significantly, with the number of folios reaching 23.4 crore and retail investors’ share in AUM rising from 23% to 28%. Smaller towns (B-30 cities) played a pivotal role, doubling their AUM contribution from 9% to 18.4%, signalling deepening financial inclusion. A wave of product innovation also reshaped the market, with thematic and sectoral funds—particularly in defence, technology, and equal-weight strategies—gaining popularity. This reflected the market’s maturity and growing appetite for targeted investment solutions. Regulatory efforts by SEBI were instrumental in strengthening transparency and investor protection. With robust disclosures, enhanced investor education, and clear governance, the Indian mutual fund industry closed June 2025 on a historic high, poised for sustainable growth ahead. The Indian mutual fund industry in June 2025 demonstrated strong growth, record AUM, and high SIP inflows, with sectoral and thematic funds—especially in defence—gaining traction, even as some categories like small cap and pharma saw short-term underperformance. The expansion was driven by increased retail participation, product innovation, and supportive regulatory and economic conditions.

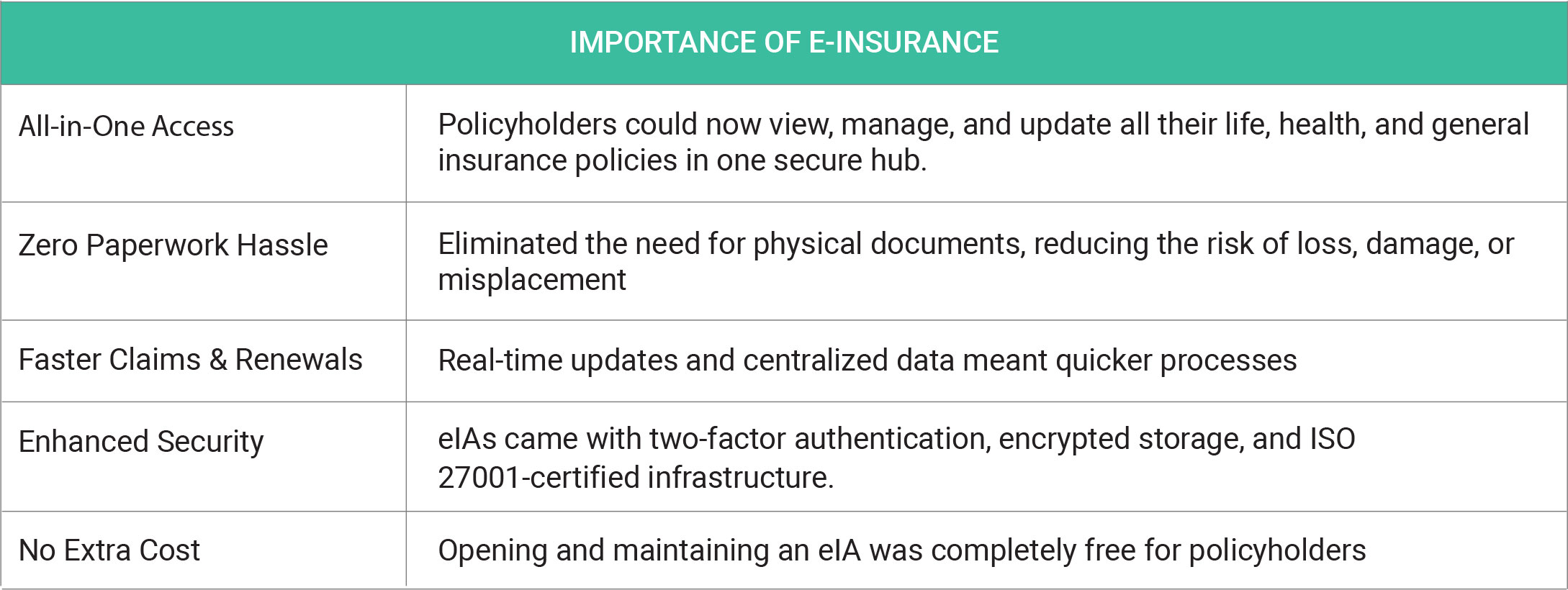

In June 2025, India’s life insurance industry recorded a robust 13% rise in premiums, signalling a strong revival after a phase of subdued growth. This upturn was largely fuelled by private insurers, whose new business premiums (NBP) surged by 16.6%, while LIC also posted a solid 10–11% increase. The industry collected over ₹30,463 crore in new business premiums in May, reflecting strong revenue growth despite a 10.4% decline in policy count—largely due to new surrender value norms introduced in October 2024. Private insurers led the momentum, with standout performers like HDFC Life and SBI Life reporting 33% and 25% premium growth, respectively. This shift highlights intensifying competition and evolving marketdynamics. The growth was primarily driven by group single premium products, which grew 13% year-on-year, while individual policy sales remained muted. LIC maintained steady performance, reporting an 11% rise in total premiums and a 21% increase in annualized premium equivalent (APE), although its retail APE saw a decline—signalling its reliance on group business for growth. The implementation of mandatory e-insurance in June 2025 marked a transformative shift for Indian policyholders, bringing insurance into the digital age with tangible benefits: Despite the impact of regulatory changes on product

mix and policy volumes, the overall industry trend remained positive. The premium surge, driven by private sector strength and innovation, sets a constructive outlook for the remainder of FY 2025–26.

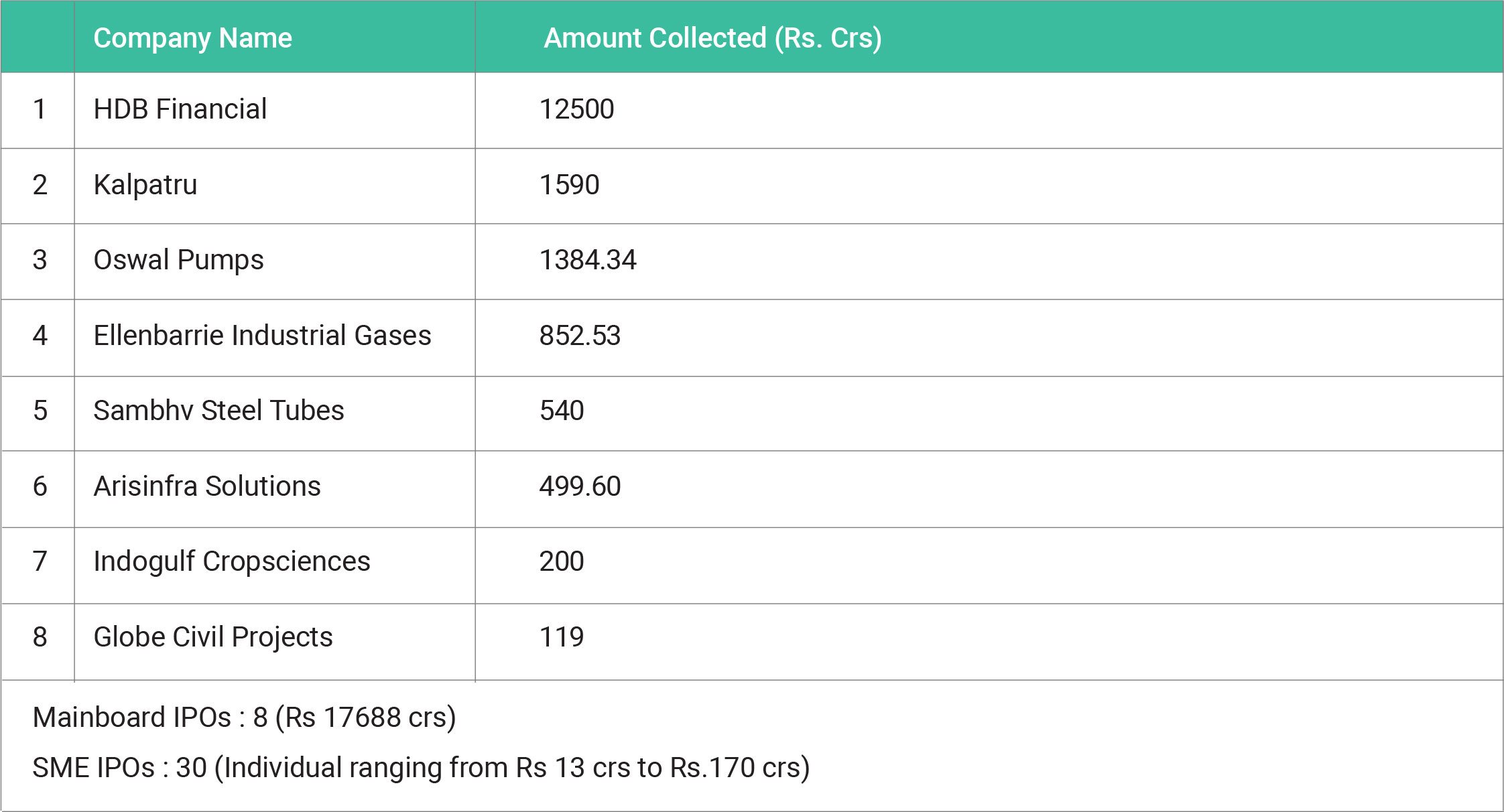

In June 2025, India saw a total of 8 mainboard IPOs and 30 SME IPOs launched, with the mainboard IPOs collectively raising ₹17,688 crore, the highest monthly fundraising in six months. SME IPOs also contributed significantly, with 30 launches in June, each typically raising between ₹13 crore and ₹170 crore. This surge in IPO activity was driven by strong retail participation and favourable market sentiment. Below are the mainboard IPOs launched in June 2025 and their respective amounts collected:

Copyright © 2021 Fintso